Категории

What is Blockchain? The Technology Behind Crypto

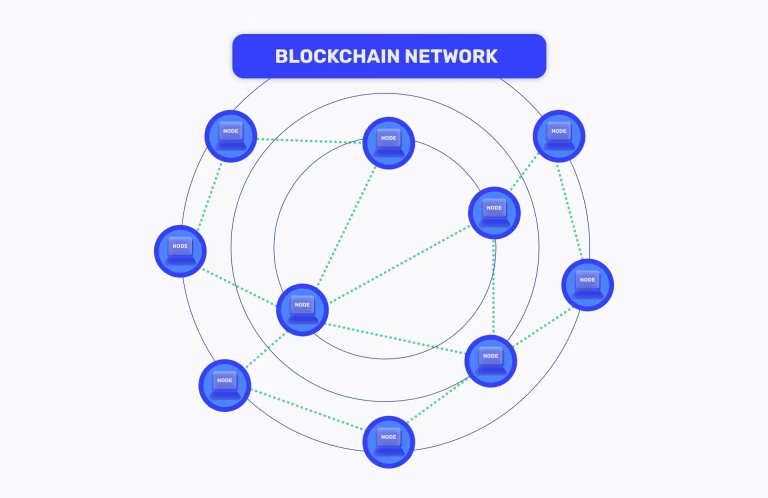

You’ve heard the term «blockchain» thrown around in discussions about Bitcoin, Ethereum, and cryptocurrencies. But blockchain technology is much bigger than just digital money. It’s [Читать далее…]