Ministry of Science and also the Ministry of Information and Communication Technology of South Korea are preparing to launch a pilot program for the development of blockchain in the country.

Under «Blockchain Technology Validation Support 2020» it is expected to be selected nine projects working with blockchain. They get 450 million won (about $360 000). Organizers of the program informed that startups will be selected according to the following criteria: the results of current performance, the possibilities for technical realization their concept in the future, the viability of the proposed technology and also a plan for the further development and the challenges, that needs to be done.

Besides, departments were said that for participation in the project firms should offer such services in which mandatory use of blockchain and services would have economic and social value. It is known, that among startups selected to participate in the program five firms have already submitted their applications for registration of a patent. Nine firms have submitted their applications for registration of copyright and two firms have conducted investment round.

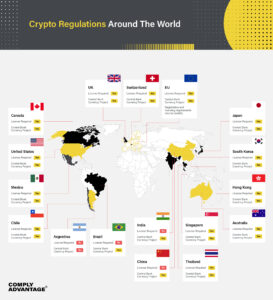

«South Korea is committed to assisting the local startups to create a business model which works at the base blockchain, Internet of Things (IoT), artificial intelligence and big data. We must evolve rapidly in this area while the market of blockchain is still young», — said Minister of Science and Technology Park Yoon-kyu. South Korea not only implements blockchain in various spheres of action but also paves the way for work the cryptocurrency companies in the country. Earlier in the month, the parliament of South Korean passed the bill to regulate cryptocurrency. Besides, in the first half of this year Government planned to submit a new law under which individuals will be required to pay income tax on their earnings obtained from trading activity with cryptocurrency.