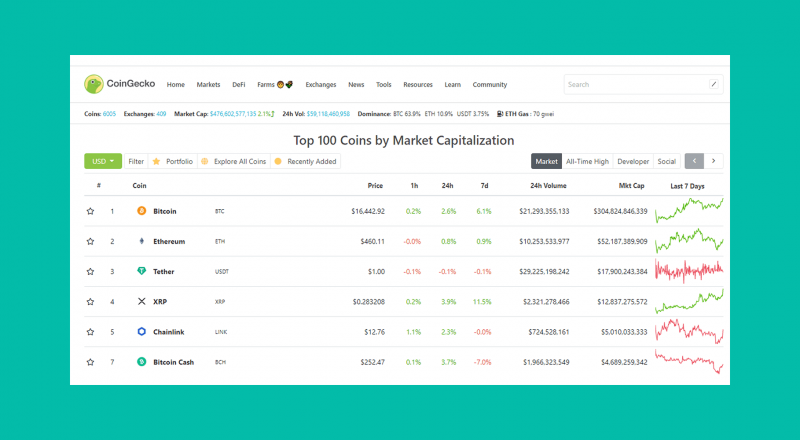

Blockchain of UPA decided to add Universal Protocol Token as well as Universal Euro and Dollar stablecoins to Bittrex cryptocurrency stock.

UPA (universal protocol alliance) unites six partners, who operate using blockchains and crypto money. Companies like Uphold or CertiK, just like Blockchain at Berkeley, and, in addition, Cred company and Bittrex have been a part of UPA since it was created. Alliance declared that universal currencies will be provided according to relevant fiat currencies (1:1 ratio). Moreover, UPEUR became a first stablecoin which is backed by the euro.

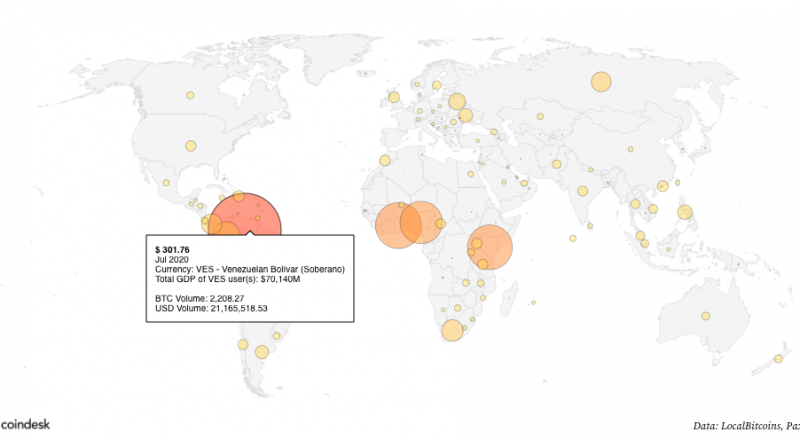

According to UPA, UPT holders will be able to take advantage of low fees and profitable annual income rate. This initiative focuses on users who live in countries with a high level of inflation so that they can hold funds or make profits in licensed banks. Despite that option, users will have access to additional opportunities provided by the platform of Universal Protocol.

Like that it will become possible to regain access to funds in the case when private keys are lost. Moreover, the user will be able to appoint the receiver of the payment, who can demand the funds’ transfer if there were no operations with the user’s account for a long time. Besides, the right to control digital assets can be transferred to a centralized exchange.

Traders will also be able to stake UPUSD with CredEarn app on Uphold. J.P. Thieriot, Co-founder of the Alliance and Head of Uphold startup, said that the UPA operations are aimed at a smooth and instant exchange of digital assets, as well as а mass implementation of stablecoins. For a dynamic token generation, the platform uses smart contracts. Last year we informed that for the Universal Protocol token support Thieriot planned to introduce a custody Ledger Vault solution.