News that really make you believe in the best!

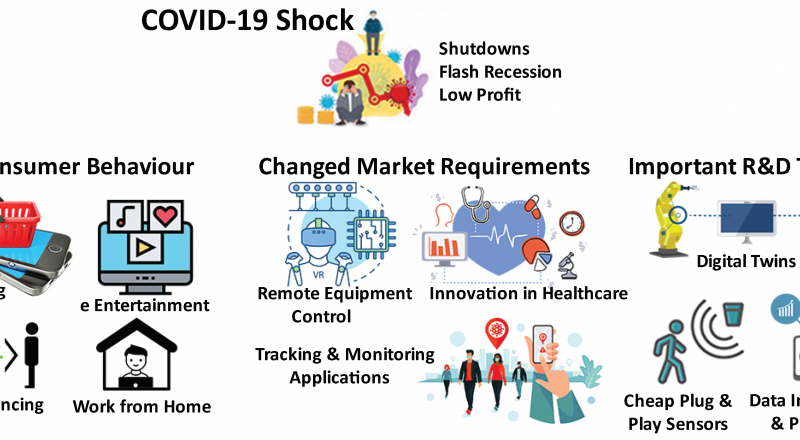

Now they are trying to find a cure not only using traditional research, but also using computer technology. This unique approach to development of pharmaceuticals is that 6,000 graphics cards will be provided to the project Folding@home Stanford University. It turns out that a large number of computers from around the world will be used to create a distributed supercomputer in order to try to investigate the main disease of 2020, which managed to make noise in all countries of the world! This decision was made at the end of February.

GPUs designed to handle repetitive computing, have been doubled due to the joining CoreWeave. Brian Venturo, who is a technical Director of CoreWeave, said that this project has all chances of finding a cure. He also noted that the Folding@home project has already introduced a contribution to creating other important medicines. So, let’s hope everything works out!

World Computer

The idea of using technology began to be realized at every moment when it was proposed; the first test systems were launched. Even if the user offers his laptop with a small margin of unused computing power, the project will take advantage of this, because any initiative is only made for the best results.

In addition to creating the medicine, computing power is used to find the necessary information, and in this case, specialists need to understand the moving parts of the protein because covid-19 contains parts of the protein, which in turn are used for reproduction and the worst part of it is the suppression of immunity. Suppression of immunity can also lead to other complications.

Miners on guard of our health

Brian Venturo encourages other miners to join the project! He hopes that all participants will help to solve the global problem, and won’t try to make money on a pandemic. For example, some scammers stole more than $2 million in cryptocurrencies due to the panic of covid-19. It sounds awful that they don’t want to solve the global problem; they only want to earn as much money as it is possible. Don’t be discouraged, as some make a huge contribution!